Read time 2 mins

Author Sophia 🌱

If you’ve ever received a gift card, you’ll know that when it comes to spending it, the experience feels somewhat different from using cash, and that’s largely down to psychology.

Regardless of whether it's a physical or digital gift card, research has revealed that the human brain perceives gift cards and money in distinct ways, leading to diverse user experiences and even alterations in spending habits.

When it comes to employee recognition and employee incentives, cash bonuses and gift cards are two of the most commonly used rewards, but they may not have the same impact on the recipient, and that’s all down to something known as Mental Accounting.

Mental Accounting is a psychological phenomenon that explains how and why we tend to assign a subjective value to our money depending on how we earned it, the form it's in and how it makes us feel.

Studies on Mental Accounting concerning cash and gift cards show that when an employee receives a cash bonus, they label it in the same way as their salary, and ultimately, it tends to be allocated to everyday essentials like utility bills, rent, or debt repayments.

On the other hand, gift cards don’t get labeled as salary, meaning they don’t disappear into everyday payments and are much more likely to be spent on fun things!

If the mental filing and subconscious categorization of gift cards as different from cash weren’t interesting enough, studies also prove that gift cards can be a more powerful motivator.

There are a couple of different explanations for this; the first is that because gift cards sit separately from salary, they feel like more of a bonus. Second, using gift cards for fun and hedonic items creates a positive association, making them more desirable to employees. When combined together, these factors result in gift cards becoming a more efficient motivator than cash alone - and that's a very powerful thing!

But the psychology of gift cards doesn’t end there, and studies have also shown that gift cards can directly influence spending habits - in particular, what we buy and how much we spend.

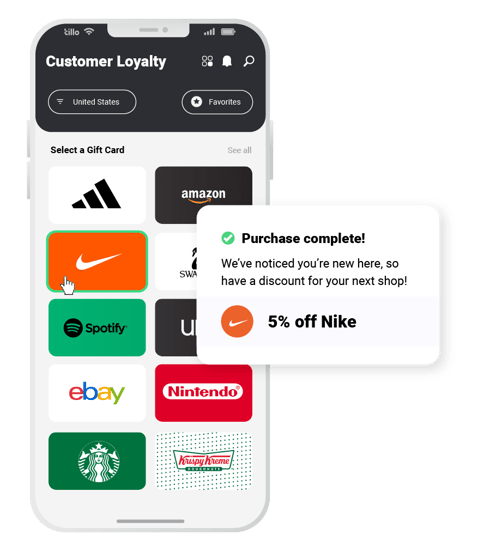

When shopping with a retailer-specific gift card, like one for Nike, studies show that the gift card holder is more likely to choose products that are typical of that brand - such as trainers or sportswear.

What's more, data from the UK Gift Card & Voucher Association (GCVA) also shows that consumers spend more when they redeem a gift card than they would if they spent cash alone.

67% of gift card users spend £18.55 more than the value of their gift card.

🚀

And even gift cards acquired for personal spending can affect spending habits. Figures show that 64% of dining decisions and 42% of clothing purchases are driven by which restaurants and retailers offer discounted or promotional gift cards.

Both cash and gift cards are well received; in fact, they’re often the two most highly rated options by employees, but as this article has shown, as far as psychology is concerned, they’re not created equal.

While no one is likely to complain about a cash bonus or incentive, offering your employees a flexible digital gift card, such as a Tillo ChoiceLink, or a versatile prepaid Mastercard like a RewardPass, may turn out to be a more thoughtful and powerful choice.

To find out more about how Tillo can support you in making employee rewards and recognition more rewarding, get in touch with us today.