Read time 3 mins

Author Sophia 🌱

The financial industry is shifting toward more open, collaborative models as digital steps it up a gear. Among these, open banking stands as a transformative solution, presenting opportunities to streamline operations, foster innovation, and provide enhanced customer experiences. However, a key challenge remains: driving adoption. One exciting strategy to overcome this hurdle involves leveraging tailored rewards and incentives, such as digital gift cards - here's how they work.

Open banking, by design, leverages technology to share user data across different financial institutions securely and in real-time. It presents the opportunity for a unified, seamless financial experience. Digital gift cards, on the other hand, are an increasingly popular choice for consumers and businesses alike, with the market projected to reach $1,101.03 billion by 2030.

These two sectors – open banking and digital gift cards – intersect in a unique and compelling way. Incorporating digital gift cards into the open banking ecosystem provides a versatile tool for customer engagement, driving additional spending, and building loyalty.

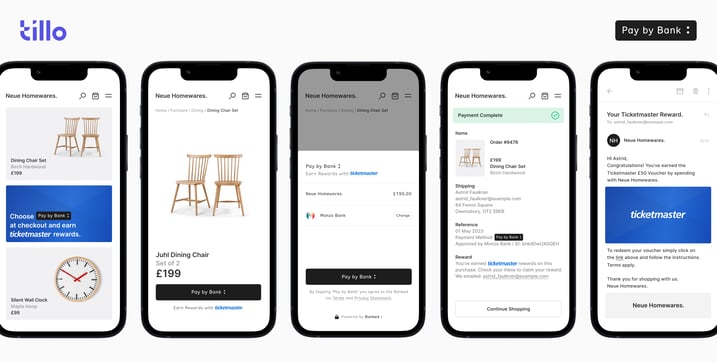

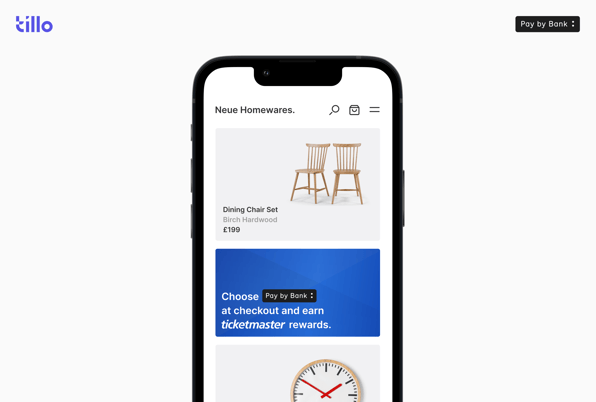

A prime example of this intersection is the recent strategic partnership between Tillo and Banked.

Banked, a direct bank payment platform, has integrated Tillo's rich gift card network into its services, allowing merchants to select from various branded incentives for point of sale. This collaboration aims to enhance the checkout conversion rates for Banked's merchants, increasing consumer adoption of Pay by Bank in the process.

By partnering with Tillo, Banked can now leverage Tillo's extensive brand catalog, accessing rewards and incentives from 2000+ global brands that people love.

Read the full press release here.

"We are thrilled to partner with Tillo and bring their digital gift cards into our incentivization and growth strategy," said Lisa Scott, CEO of Banked Europe.

"This collaboration will play a significant role in driving awareness around Pay by Bank as a simple, secure, and fast way to make payments and also a way to offer meaningful benefits to consumers."

The Buy Now, Pay Later (BNPL) market is another area where tailored rewards are making a significant impact. Providers like PayPal’s Pay in 4, Klarna, and Affirm have seen increased use globally, especially amongst younger generations. Still, competition is heating up, and they must do more to retain their market share.

One leading BNPL platform has integrated Tillo’s gift card network to power its loyalty cashout options. Customers earn loyalty points when using BNPL services or making timely payments. These points can then be converted into digital gift cards, incentivizing continued use of the platform and driving long-term customer retention.

By partnering with Tillo, this leading BNPL gained access to a uniform solution that could be seamlessly used across multiple markets and currencies, making it easy to reward and delight their customers at scale.

Open banking fundamentally redesigns the financial landscape by facilitating data sharing among financial institutions in a secure, real-time environment. Data sharing allows for a more integrated financial experience, offering consumers greater control over their financial information and enabling businesses to provide more personalized services to their customers. However, despite these benefits, getting consumers to embrace and trust the concept of data sharing within open banking can take time and effort.

Fortunately, incentives such as digital gift cards can play a crucial role in driving the adoption of new technologies. They provide an immediate, tangible benefit that can motivate potential users to explore and engage with alternative offerings, like Pay by Bank.

Digital e-gift cards, in particular, stand out as a powerful incentive because they’re extremely flexible and can be highly personalized to the recipient. Unlike other incentives, digital gift cards can also be issued and redeemed online, aligning with the digital nature of open banking services and ensuring that users can access their rewards quickly and easily.

The use of tailored rewards and incentives, such as digital gift cards, can also help to foster loyalty and encourage ongoing engagement. By rewarding users for engaging with open banking services, businesses can help build positive associations with their new initiatives, creating memorable experiences and deepening customer relationships, ultimately resulting in long-term loyalty.

Positive experiences such as these are particularly beneficial for open banking platforms, where ongoing user engagement is critical to unlocking its full potential and driving sustainable and profitable growth as the market heats up.

At Tillo, we make it easy for fintechs to unlock the potential of digital gift cards as rewards and incentives. Our industry-leading API provides a unified gateway to over 2000 digital gift card brands, creating an effortless way to engage and excite your customer base, whatever their tastes.

To learn more about the Tillo Platform and understand how Tillo can serve as a catalyst for your fintech business, reach out to us today!