Read time 2 mins

Author Ro Garza 💫

The Buy Now, Pay Later (BNPL) sector has seen explosive growth in recent years, with key players such as PayPal's Pay in 4, Klarna, Clearpay, Zip, Sezzle, Afterpay and Affirm gaining popularity at the checkout of online shops worldwide. As the market continues to grow and become more saturated, BNPL providers must find new ways to differentiate themselves and retain their audience share.

The digital gift card industry has also been experiencing its own remarkable boom, with the global market value sitting at $258.34 billion in 2020 and anticipated to soar to $1,101.03 billion by 2030. While digital gift cards have grown for many years, their continued popularity can be attributed to several key factors.

💸 Firstly, there has been a noticeable increase in the use of digital gift cards as an alternative payment method. During the cost of living crisis, consumers have increasingly turned to digital gift cards to help them budget and as an opportunity to capitalize on gift card discounts and make savings.

🏦 Secondly, digital gift cards are increasingly being used as a cash out option for cryptocurrencies and alternative digital coins, giving the unbanked a way to make everyday purchases without facing the hefty fees or long delays associated with cashing out to Fiat currencies.

🚀 And finally, digital gift cards are proving to have a crucial role in business development. Businesses of all shapes and sizes increasingly use digital gift cards to promote their brand, attract new customers, engage their users, and encourage customer loyalty.

Learn why digital gift cards are the secret weapon for neobanks

📖

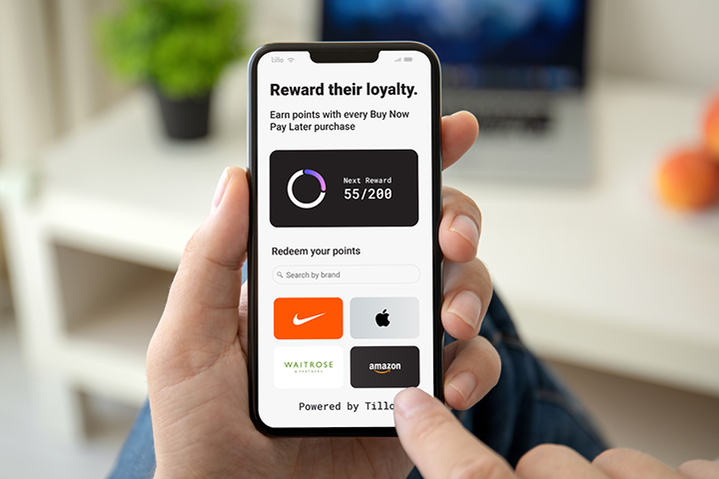

For BNPL providers looking to stay competitive, integrating digital gift cards into their platform offers a unique opportunity to enhance their value proposition.

.png?width=522&height=348&name=Pay%20in%204%20final%20(1).png)

Here are some of the ways that digital gift cards can help to improve the customer experience of BNPL users.

🧲 People want digital gift cards

Digital gift cards are highly sought after, making them an ideal tool to attract new users, especially younger generations who are more likely to use BNPL services.

Though BNPL services are currently predominantly used by younger generations, there has been a marked uptick in their adoption by older age groups in the U.S.

Consequently, introducing digital gift cards as rewards could be a strategic move for BNPL providers to extend their appeal and reach out to a more diverse audience that is familiar with the use of gift cards as rewards and a payment method.

🎉 Digital gift cards make great rewards and incentives

Digital gift cards are also a great way to reward existing customers, increasing their engagement with BNPL services and helping to build long-term loyalty.

Whether encouraging additional spending, rewarding early repayments, or simply saying thank you for the long-term use of their platform, digital gift cards are a cost-effective and highly targeted solution.

🛍️ Gift cards can be highly personalized

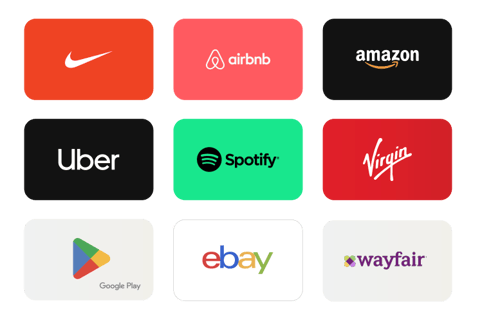

With consumers increasingly seeking a personalized experience, digital gift cards also offer an easy way for BNPL providers to customize their users' rewards and incentives.

Integrating with a global gift card platform makes it easy for BNPL to surprise and delight each and every one of its users, no matter their shopping preferences.

Integrating digital gift cards into BNPL platforms presents a promising avenue for growth and differentiation in a competitive market.

At Tillo, we offer a plug-and-go API that enables BNPL businesses to easily integrate our rich catalog of 3000+ global brands into their existing interface.

With our industry-leading customer care and powerful gift card discounts, we are perfectly poised to help BNPL providers unlock the untapped potential of digital gift cards and drive sustainable, profitable growth as the BNPL market scales.

Discover what Tillo can do for you and unlock the potential of gift cards today.